China needs time to complete transition, if it will

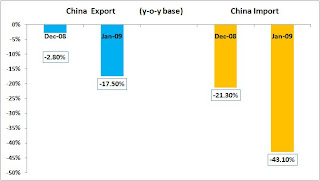

Now the trade pattern for China is very interesting. With sharp decline in export and import, China’s trade surplus for January was a mind-blowing $39.1bn, just under November’s all-time high of $40.1bn. In comparison, in the first half of 2008 China’s average monthly trade surplus was an already high $16.7bn. In the second half it surged to $32.9bn.

Now the trade pattern for China is very interesting. With sharp decline in export and import, China’s trade surplus for January was a mind-blowing $39.1bn, just under November’s all-time high of $40.1bn. In comparison, in the first half of 2008 China’s average monthly trade surplus was an already high $16.7bn. In the second half it surged to $32.9bn.The global economy is experiencing a sharp contraction in demand – which must be “shared” among all of the world’s producers. The decline in Chinese exports means that Chinese producers, of course, are absorbing part of that contraction; but the bigger decline in imports means that Chinese consumers are contributing a greater amount to the contraction in global demand.

What does it mean? It means the net result is non-Chinese producers must absorb more than 100 per cent of the contraction in demand from non-Chinese consumers. So no doubt we hear a lot of talks attacking the China trade and associated finance policies.

For China policymakers, they would nonetheless like nothing more than to see China increase consumption sharply. To that end they have unveiled a fiscal stimulus package and forced banks to expand lending at a pace so rapid – January’s new loans equaled one-third of all new loans in 2008 – it will almost certainly lead to a sharp rise in non-performing loans. However, the problem is that its weak consumer base make it very difficult for China’s fiscal stimulus to cause a rapid net increase in consumption. The most possible problem is that China will continue to export huge amounts of overcapacity into a world struggling with collapsing demand.

This can easily lead to worsening trade friction. Already Asian countries from India to Indonesia are squabbling fiercely over Chinese exports and western economies from France to the US are veering towards protection.

But trade war is not the solution. Threatening China with trade sanctions if it does not rapidly reduce the rising overcapacity it is forcing on to the rest of the world will not work. There is very little Chinese policymakers can do in the short run without causing a collapse in the export sector and a rise in unemployment so rapid that it could lead to social instability.

Again, my view is the world must recognize that China can adjust, but it cannot adjust immediately. It will take several years to do so, and will require significant changes in its financial system, in its political system and in its development model. To that end large economies need to work out a plan in which China is given a reasonable amount of time to make what will inevitably be a difficult transition. As part of the plan, the US, Europe and other big economies must assure open markets to Chinese exports.

The world, with US president Barack Obama in the lead, has a tremendous opportunity to help China through a difficult transition and, in so doing, create a new sustainable global balance of payments and a favorable institutional framework that will govern trade and capital relations for decades to come. If not, the advantages trade deficit countries receive from pushing the full burden of adjustment on to trade surplus countries will be overwhelmed by a global environment of deep mistrust and hostility.

This is not the time to attack China. China has a serious overcapacity problem that can best be worked out in global co-operation over years. To demand a quick resolution will bring nothing but trouble.

Labels: china

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home