M&A retreated in 2008

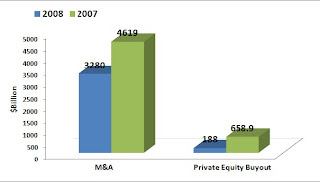

A record number of deals were cancelled in 2008 leading to a sharp fall in fees for investment bankers. The total volume of worldwide mergers and acquisitions reached $3,280bn in the year to date, down 29 per cent from the full year 2007 as financing difficulties, volatility in valuations and widespread risk aversion saw deals pulled.

A record number of deals were cancelled in 2008 leading to a sharp fall in fees for investment bankers. The total volume of worldwide mergers and acquisitions reached $3,280bn in the year to date, down 29 per cent from the full year 2007 as financing difficulties, volatility in valuations and widespread risk aversion saw deals pulled.Companies abandoned 1,309 transactions valued at a total of $911bn. In 2007, there were 870 withdrawn deals valued at $1,160bn.

BHP Billiton’s $147.bn bid for fellow miner Rio Tinto was the largest-ever withdrawn deal while the $48.5bn acquisition of Canada’s BCE telecoms group by a consortium of private equity groups marked the biggest failed buy-out ever. On the other hand, the fall in activity saw investment bankers generate less than $20bn in fees for advising on M&A in 2008, down 30 per cent from the $28.1bn in 2007.

But the floor has not been built yet. The combination of falling earnings, the absence of credit, lack of confidence and ongoing market volatility will deter activity. M&A outlook for 2009 was the worst for many years.

Deals among financial institutions helped prop up the volume of deals as banks and insurers raised capital and restructured assets to repair balance sheets.

Financial deals accounted for 19 per cent of all M&A volume with $636.6bn deals during the year, including the $44.4bn acquisition of Merrill Lynch by BoA. What’s worse, Private equity deals fell 71 per cent to $188bn from $658.9bn in 2007 – the lowest annual volume in five years as lenders stopped providing debt for buy-outs.

Labels: crisis, investment bank

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home